YOUR BUSINESS DESERVES MORE THAN A ONE-SIZE-FITS-ALL PAYROLL

Why Small Business Owners Choose Ponce Payroll Solutions

Tailored for Small Teams

Specializing in single-owner LLCs and S-Corps with 20 employees or fewer

Freedom to Choose Vendors

Never locked into all-in-one packages! We integrate with your preferred providers.

Not sure where to start? We have trusted resources to connect you with but the choice is up to you.

Personalized, Human Support

No call centers. Real people, real answers, when you need them.

Our Services

-

Modern payroll with compliance handled for you — direct deposit, tax filings, timekeeping, and integrations for benefits and retirement.

-

Solo entrepreneurs who skip payroll often overpay in self-employment tax. We set up compliant, low-maintenance payroll for one-person businesses so you don’t leave money on the table.

-

Seamlessly connect health insurance, retirement plans, workers’ comp, and your existing CPA to payroll without being locked into a bundled provider.

-

Electronic filing, mailing, and IRS compliance for 1099-NEC/MISC/INT — available even if you are not a payroll client.

-

Compliant payroll for nannies and in-home caregivers (“nanny tax”) — issue W-2s and stay in good standing with federal and state rules.

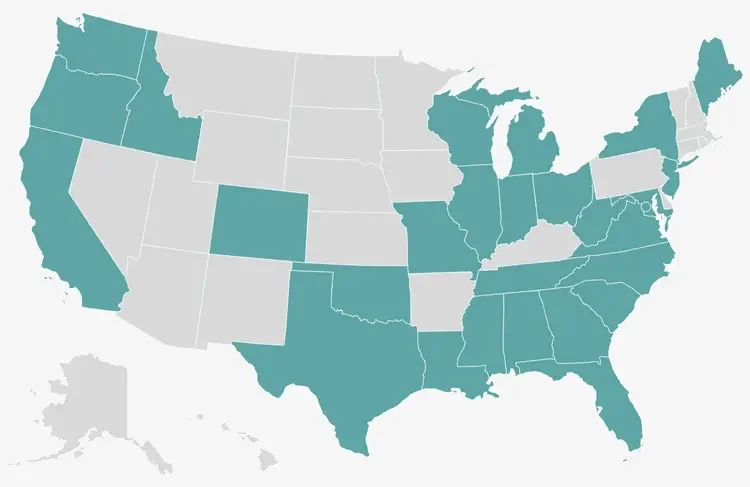

Currently Serving Clients in 27 States!

More Than Payroll — We're Part of the Community

Ponce Payroll Solutions is a family-run business built on decades of payroll experience. Jason Butler got his start working in his mom’s bookkeeping business and discovered early on that payroll is about more than numbers — it’s about people.

Now based in Monument, Colorado, Jason and his wife Amanda work together to make payroll simple, accurate, and stress-free for businesses of all sizes, so you can focus on growing your business while they handle the details.